ICHRA

What is an ICHRA?

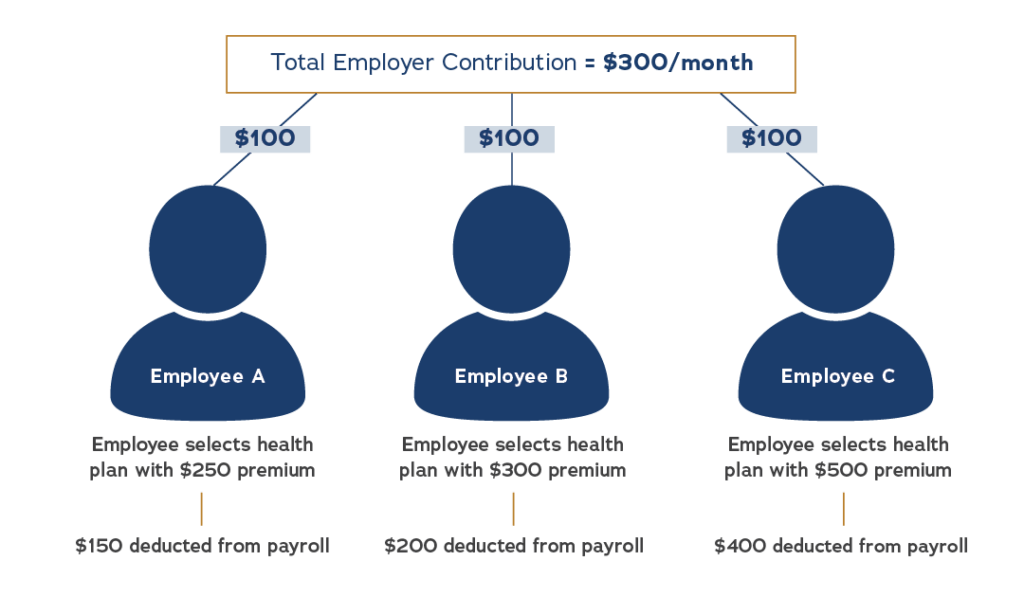

ICHRAs are a way for you to provide your employees with health insurance while managing what it costs you to provide it. With an ICHRA, you set the dollar amount you want to contribute towards your employee’s monthly individual health insurance premiums. Employees then can choose a health plan that best fits their needs.

Is an ICHRA Right for your business?

Are you interested in offering benefits but not sure where to start?

Do you want to save money on your health insurance costs?

Have you had trouble meeting participation requirements on traditional group plans?

Are you interested in tax savings opportunities?

Do you have employees who prefer to choose their own health plans?

How Does an ICHRA Work?

- You determine which of your employees are eligible to participate.

- You set a monthly amount to contribute towards employees’ health plan premiums.

- Employee select an individual health plan.

- Any remaining balances can be payroll deducted.

ICHRAs are Growing in Popularity.

There are noteworthy advantages and benefits to both the employer and employee that company benefit managers should consider.

ADVANTAGES FOR EMPLOYER

- Tool to attract and retain talent

- Tax advantages on contributions provided

- No contribution or participation requirements to sign up

- Easy to use, online tools to enroll employees and manage and fund contributions

- Option to offer different contribution amounts to different classes of employees through payroll deduction

BENEFITS TO EMPLOYEE

- Flexibility in choosing a plan that works best for him or her

- Ability to keep the plan if he or she leaves the company or changes jobs

- Contributions are not taxable to the employee and are excluded from his or her gross income

- Option to potentially earn tax credits to lower monthly plan costs

- Special enrollment opportunity on the Marketplace if eligible

Every Employee Plan can be unique

Employer pays the list bill to the carrier

Employer & Employee ICHRA contributions are paid directly to the Insurance Carrier by the employer once all of the calculations are made by ICHRA Masters.

The employee does not have to upload proof of premium payments or do any administrative tasks associated with their plan.